Accept Your Federal Direct Unsubsidized and/or Subsidized Student Loans

The U.S. Department of Education offers low-interest loans to eligible students to help cover the cost of education.

BEFORE YOU CONTINUE: If you have placed a security freeze on your credit file, you must lift or remove the freeze at each credit bureau before you continue. Your application will not be processed if you have a security freeze.

Follow the steps outlined below to accept your loans:

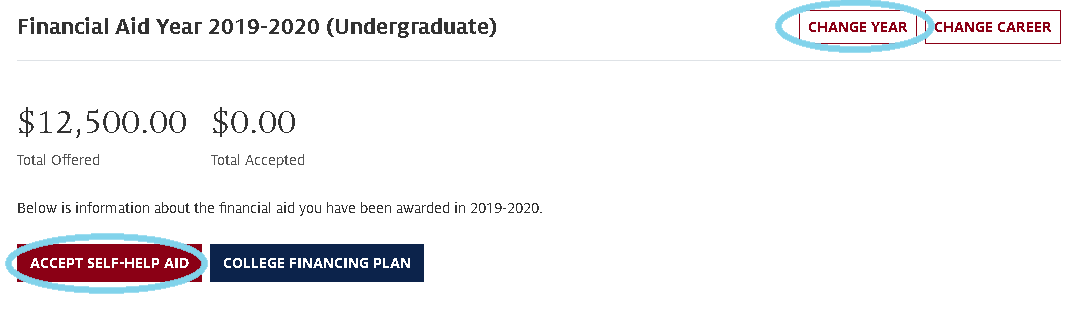

- Log in to your UAccess Student Center and select "Financial Aid Summary" under the "Financial Aid" menu.

- Select the appropriate aid year using the "Change Year" button and click the "Accept Self-Help Aid" button.

If you are progressing from one career to another between semesters (i.e., graduating from the University of Arizona in Fall 2020 and starting a graduate program Spring 2021), review the Undergraduate to Graduate Loan Acceptance page for instructions on how to accept loans for your new student career.

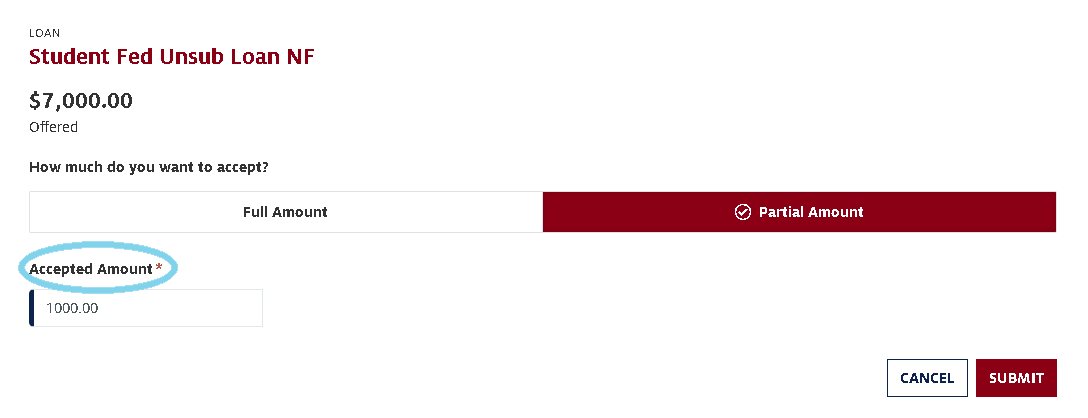

3. You can elect to accept less than the full amount offered by clicking the "Partial Amount" button, entering the amount you would like to accept in the "Accepted Amount" field, and clicking "Submit". If you would like to accept the full amount offered, click the "Full Amount" button and click "Submit".

Loans for students enrolled the full academic year will be split evenly between the fall and spring semesters. Be sure to accept the total loan amount needed for the entire school year!

4. Follow the prompts to complete the acceptance process.

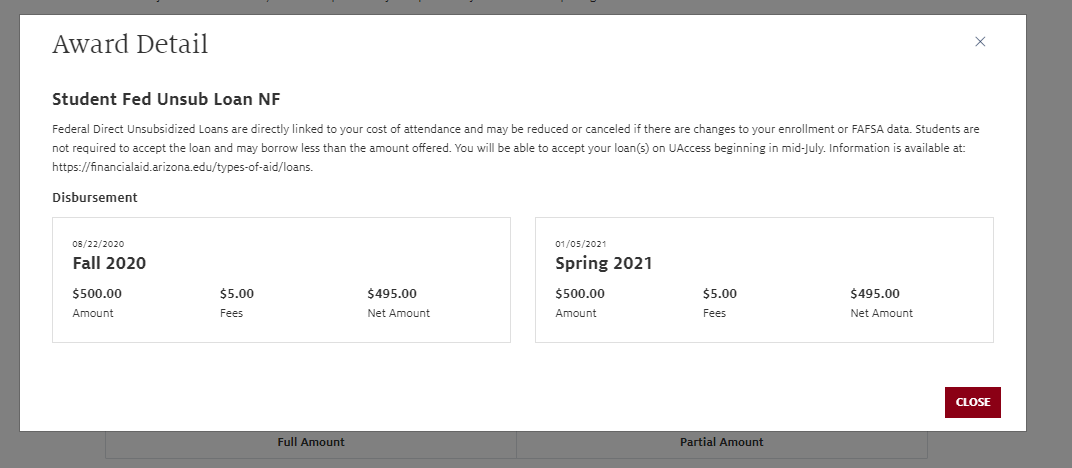

5. You can confirm the amount you accepted and see how it will be split evenly between semesters after you accept it. First, click the "Accept Self-Help Aid" button and then click the name of the accepted aid you want to review.

Note:

- You are not required to borrow any or the full amount of loans offered to you.

- If you do choose to borrow loans, you are able to decide how much you would like to borrow, up to the amount you were offered. If you would like to borrow less than you were offered, simply accept a lesser amount than the total you were offered.

- To better understand what you will owe after you complete college and go into student loan repayment, check out this helpful Loan Simulator from studentaid.gov.

- Graduate/Professional students applying for the Graduate PLUS Loan: If you have placed a security freeze on your credit file, you must lift or remove the freeze at each credit bureau before you continue. Your application will not be processed if you have a security freeze.

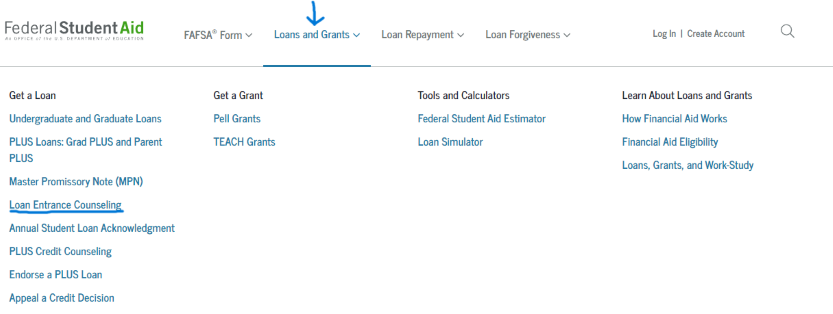

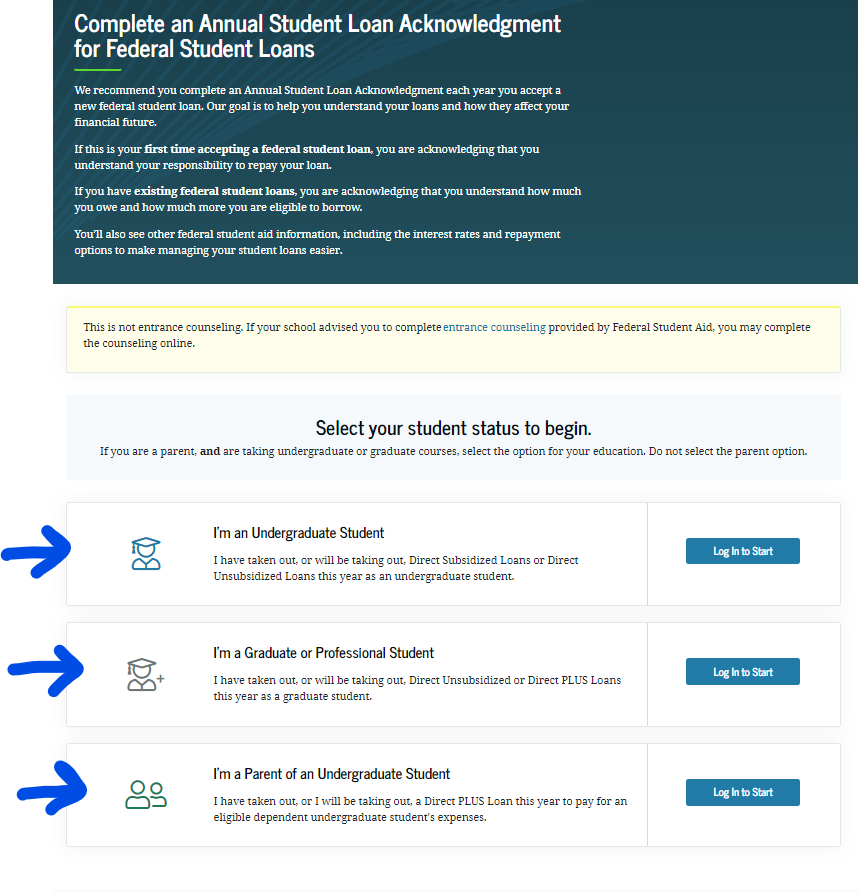

First-time federal student loan borrowers must complete loan entrance counseling with the U.S. Department of Education before loans can be released. Entrance counseling will help you understand the terms and conditions of your loan and your rights and responsibilities. We want you to understand what a loan is, how interest works, and what your options are for repayment after you graduate.

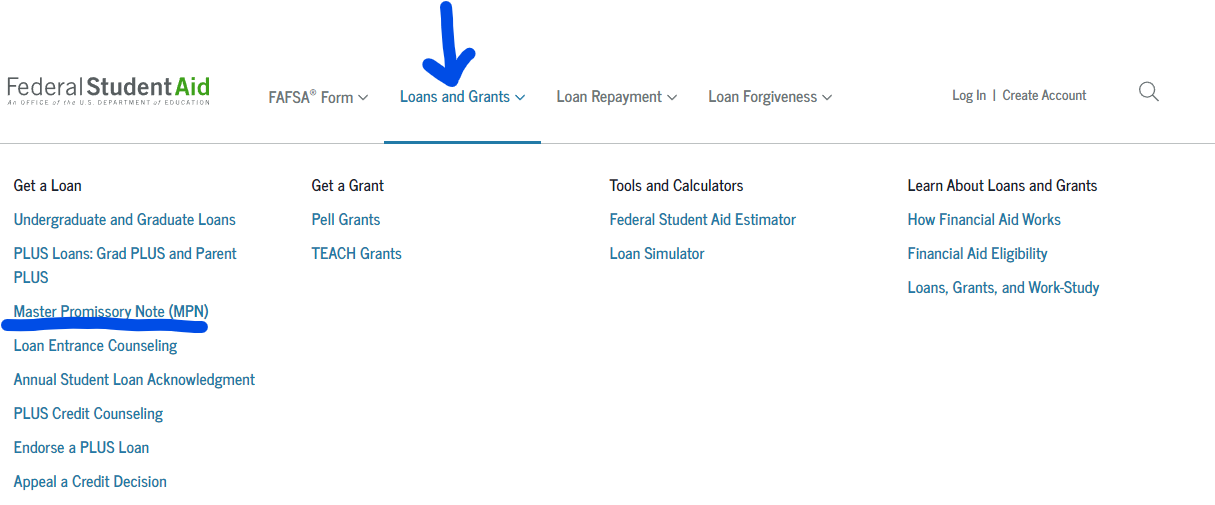

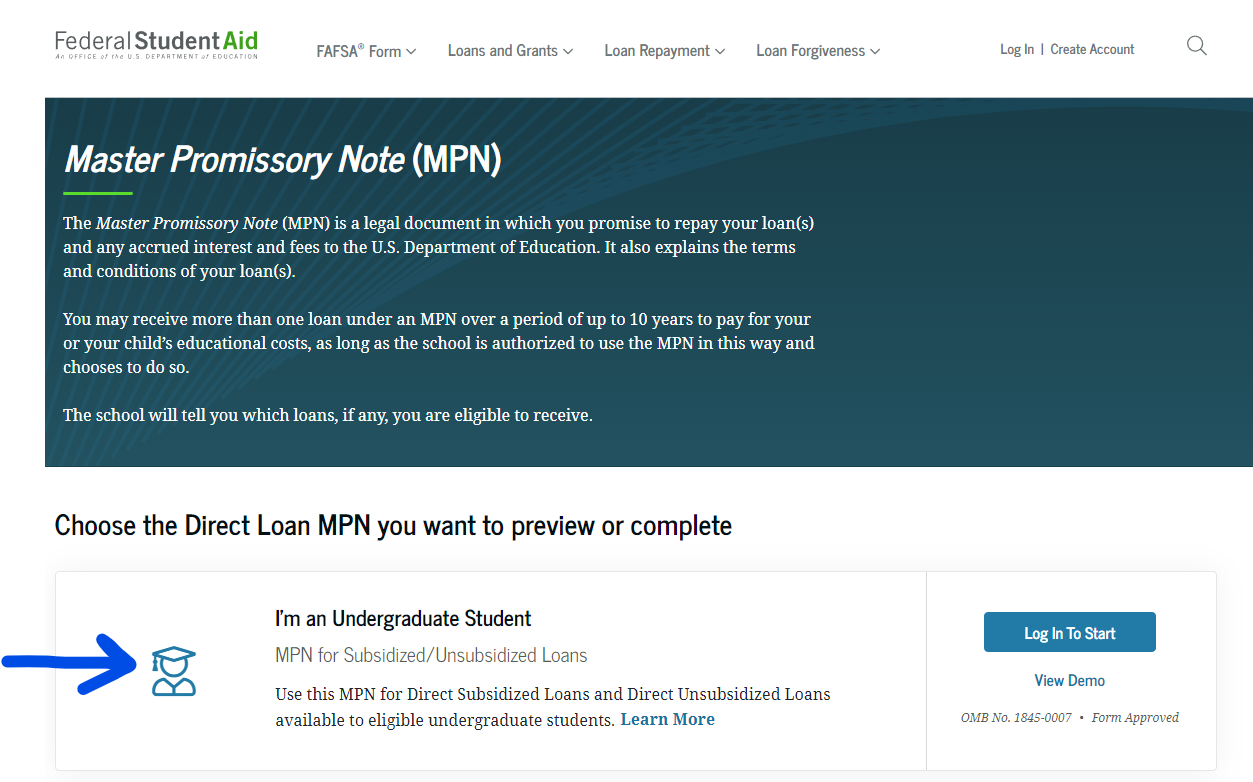

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loans and any accrued interest and fees to the Department of Education. The MPN will explain the terms and conditions of the loan you will receive.

You must complete an MPN with the U.S. Department of Education if:

- You are a first-time federal student loan borrower and an MPN has never been completed.

- No actual loan funds were borrowed within 12 months of signing your last MPN.

- Your current MPN has expired and is no longer valid. (MPNs are only valid for ten years)

- You directed the lender to terminate an MPN to stop any new loans from being borrowed under the MPN.

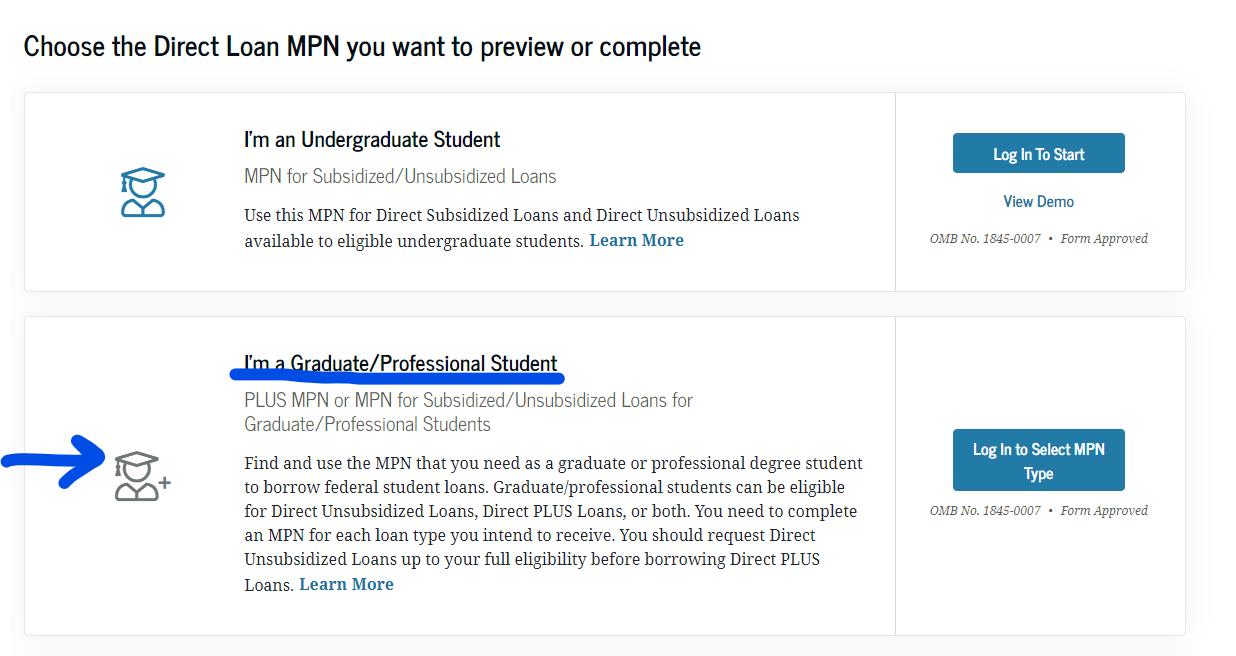

Graduate PLUS Loan Borrowers must complete a Graduate PLUS MPN if:

- You have never completed a Graduate PLUS MPN that lists the University of Arizona as the designated school. (This is a different MPN than the Federal Direct Subsidized and Unsubsidized loans)

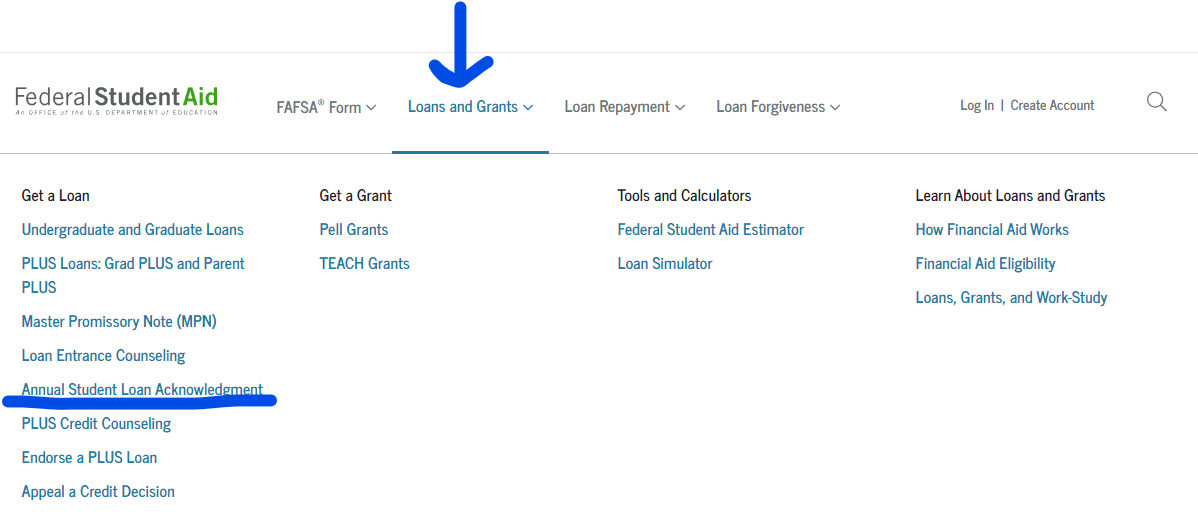

Both first time and current University of Arizona federal student loan borrowers may complete the annual student loan acknowledgment with the lender, the U.S. Department of Education each year.

Confirm Which Charges to Pay

Students must grant the University of Arizona permission to pay charges other than tuition and fees (such as bookstore charges to your Bursar student account) with their federal student financial aid.

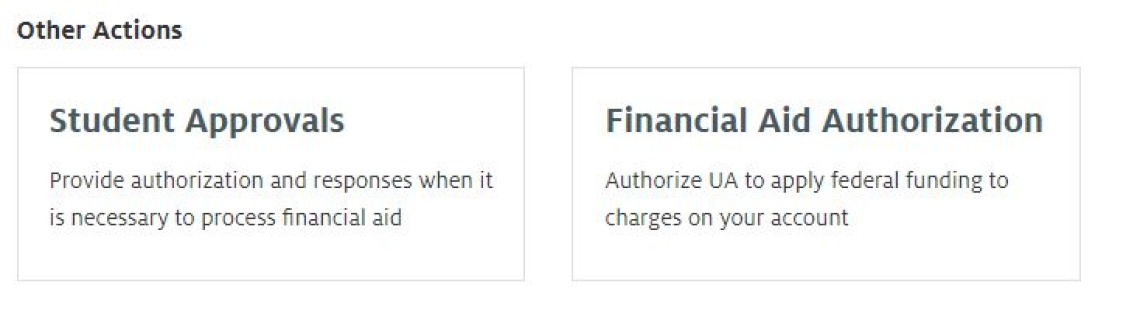

- Log into your UAccess Student Center and select Financial Aid Summary under the Financial Aid menu.

- At the bottom of your Financial Aid Summary under the Other Action section, click Financial Aid Authorization and grant Arizona permission to pay any current charges on your bursar account.